In the early months of 2024, the real estate scene in Phoenix experienced a dip in home prices, marking a departure from the trend observed previously.

According to the latest data released, while Phoenix metro housing prices commenced the year on a slightly lower note compared to the end of 2023, they remained significantly higher than the levels recorded a year earlier.

Phoenix Experienced a Decline in Home Prices: The current situation presents a stark contrast

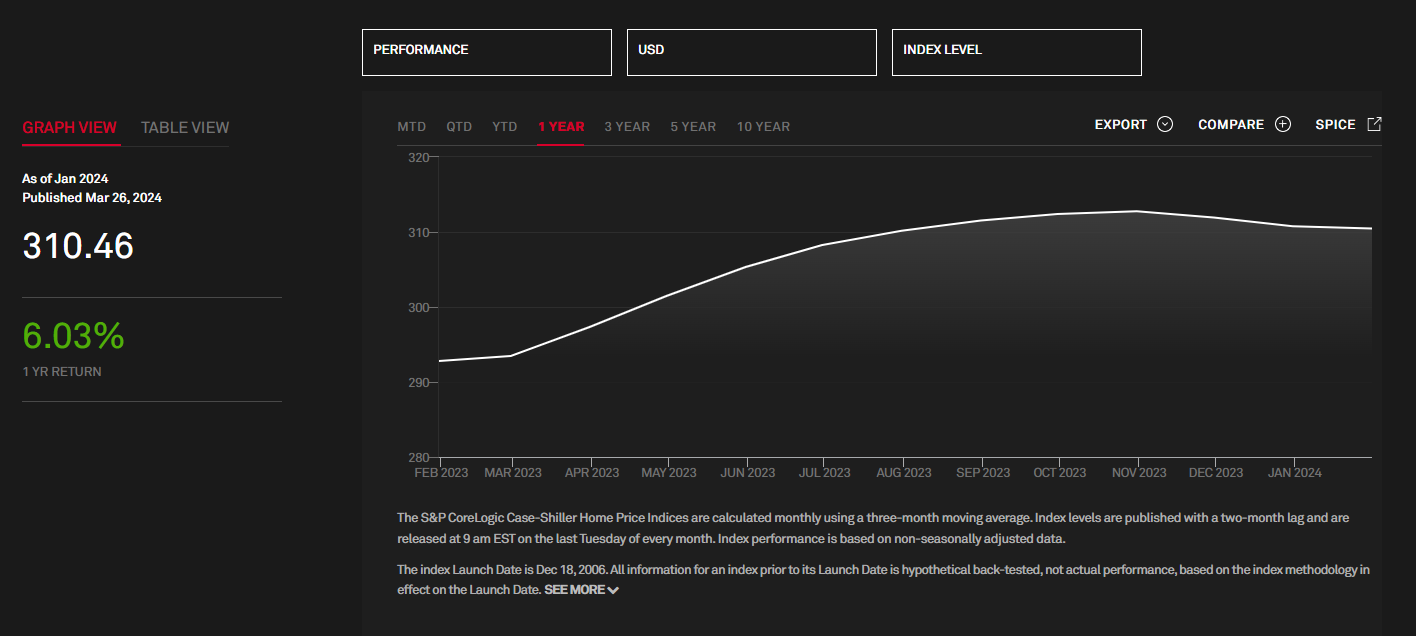

The recently unveiled S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, published on Tuesday, revealed a year-over-year increase of 4.6% in home prices for January.

Despite this positive trend, the median price, standing at $326,960, saw a marginal decline in home prices of 0.5% from December.

Micheal Hilliard, a Partner and Founder of residential real estate investment firm Amazing Offer, attributed the January numbers to a period of subdued buyer demand in the latter part of 2023, following a peak in mortgage interest rates at 8% in October.

However, Hilliard emphasized a notable shift in the current scenario. With interest rates now below 7% and buyers growing impatient, there has been a resurgence in demand for homes.

Desirable properties are often receiving multiple offers, albeit not reaching the frenzied bidding wars of 2021. Nonetheless, recent sale prices reflect buoyant market sentiment.

Looking ahead, Hilliard pointed out that pending sales in March indicate a robust increase of over 5% in Valley home prices compared to a year ago.

He confidently projected a further rise of 6% to 8% by year-end, surpassing the trajectory of interest rates. This optimism aligns with earlier forecasts made by Hilliard and other industry experts.

Hilliard emphasized a changing perception among buyers, who now view moderately higher interest rates as manageable, given the concurrent rise in home prices.

He stressed the importance of seizing opportunities in a market where home prices are on an upward trajectory, as opposed to waiting for potential interest rate drops.

On a national scale, the Case-Shiller index highlighted a rapid 6% annual increase in housing prices for January, marking the index’s swiftest growth since 2022.

However, while home prices soared in most markets, 17 out of the index’s 20 markets experienced a month-to-month decline in home prices in January.

In Phoenix, Hilliard observed a steady uptick in home values alongside a slight increase in available inventory, hovering around 16,000-17,000 homes.

Although this figure falls short of the typical “normal” range of 20,000-25,000 homes, the current listings-to-sales ratio slightly favors sellers, contributing to the upward trajectory of home values.

Despite these positive indicators, Hilliard acknowledged that the Phoenix housing market remains good but not exceptional, with signs of gradual improvement.

A recent study identified Arizona among the 10 least affordable states for homebuyers, reflecting the ongoing challenges in the real estate landscape.

To address the housing demand, homebuilders and developers continue to invest in both build-to-rent communities and large-scale master-planned developments across Arizona.

Recent land acquisitions in the East Valley indicate sustained efforts to meet the housing needs of residents, with hundreds more purchases underway, signaling a promising future for the region’s real estate sector.