Amid the palm trees of Jupiter Island, Florida, you’ll find a three-bedroom, five-bathroom house on a half-acre lot, perfectly reflecting the rising of home prices in the area. This house has a stunning pool.

Believe it or not, this 2,798-square-foot house, only a few steps from the beach with an ocean views, is currently listed for a staggering $5.1 million. It’s the cheapest house for sale on Jupiter Island, which has the highest median home value in the country.

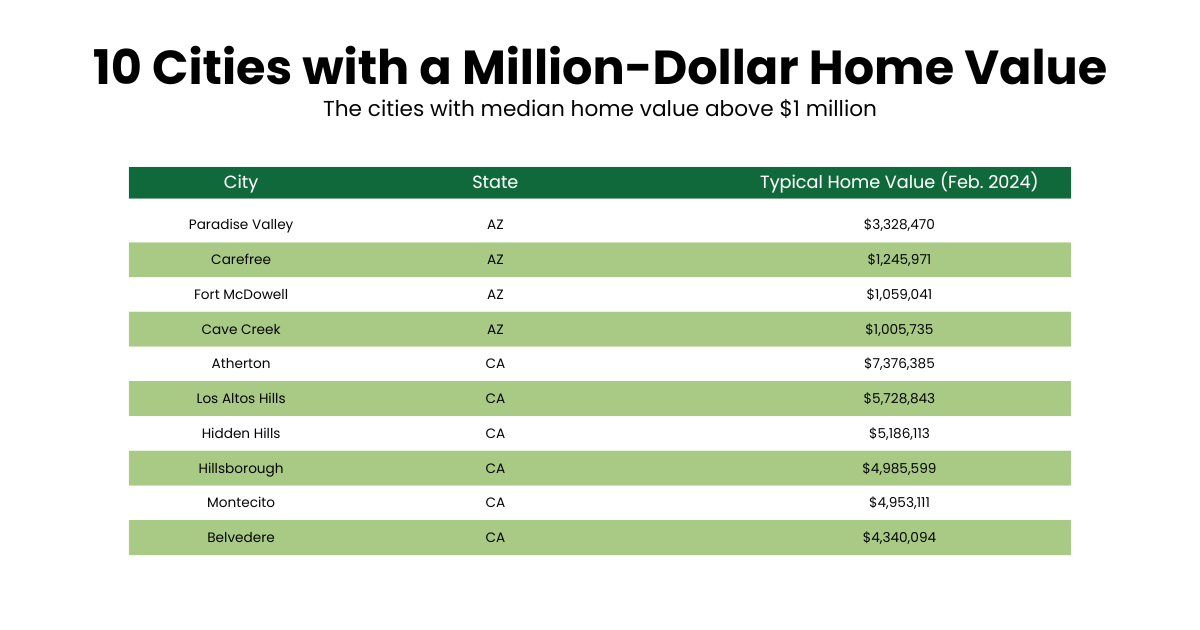

In February 2024, the typical home value on Jupiter Island skyrocketed to $9.98 million, higher than the exclusive neighborhoods of Golden Beach, Florida; Hunts Point, Washington; and Atherton, California.

Although certain cities and neighborhoods have traditionally had eye-popping price tags, Amazing Offer research has found that the number of cities with median home value exceeding $1 million has skyrocketed in recent years.

In January 2000, there were only 17 cities with median home prices with approximately $1 million. This number grew to about 245 cities by February 2020, just before Covid-19 pandemic. In the past four years, this figure has more than doubled, to 550, thanks to home prices skyrocketing amid a blistering market with limited inventory.

Since then, skyrocketing home values and higher interest rates have kept many buyers out of the market, making it hard to participate. This has meant relief in terms of lowering the prices.

“Affordability remains a significant challenge for buyers, but that hasn’t stopped prices from rising“ according to Amazing Offer. “This spring buyers will find more options to choose from, but they’ll also encounter many other buyers at the same open houses. Competition will remain intense, especially for the most attractive and reasonably priced homes. If mortgage rates decline later this year, as many anticipate, we could see a surge in million-dollar cities as additional buyers jump in and drive prices higher.”

According to Amazing Offer Research, nearly half of the million-dollar cities are in California, approximately 220 of them, while 32 million-dollar cities are in Florida, mostly around Miami or Orlando areas. New York has 66, while New Jersey has 49 million-dollar cities.

Sellers are slashing home prices

In the wider housing market, an increasing number of sellers are reducing their asking home prices.

According to data from real estate firm Redfin, 6.4% of active listings on their platform had a price drop during the May 26 week ending. While that’s not a huge chunk of listings, it’s a lot more than the 4.4% of listings with price drops at the same time in 2023. It’s also higher than the percentages from 2022 and 2021.

Fewer homes are selling within two weeks of being listed, down to 42.9% in the week ending May 26 compared to 45.7% during the same period last year.

Also, new listings have increased by approximately 7.8% compared to the same time in 2023, although both figures remain below the level of previous years’ marks. Yet, home prices keep rising in many parts of the country as buyers fight over the same homes.

The lack of inventory stems in part from the perception that homeowners are “locked in” to their current homes, driven by the exceptionally low interest rates during the height of the pandemic. The Federal Reserve began rapidly increasing rates in 2022, more than doubling mortgage interest rates. With high interest rates and rising home prices, the median monthly housing payment has jumped to a record $2,843 , according to Amazing Offer, which is 13% higher compared to the same period last year.

However, there are some positive developments. Areas in Texas and Florida are some of the best places for buyers. This is partly due to the significant amount of new homes being built in cities like Austin and San Antonio, as well as Tampa, Orlando and Jacksonville.

Skylar Olsen, chief economist, stated in a news release, prospective buyers in most markets today are experiencing less intense competition compared to recent spring shopping seasons. Pressure is easing up as mortgage rates increase costs and sellers return,” However, the inventory of homes for sale remains remarkably low. Consequently, the nation continues to be a seller’s market despite high mortgage rates, homes are selling faster and attracting more buyer interest per listing, than pre-pandemic levels.”