7 Real Estate Shifts That Could Change the Way Phoenix Buys and Sells Homes by 2030

Suppose you’ve been watching the Arizona housing market. In that case, whether you’re in Phoenix, Mesa, or any of our fast-growing suburbs, you’ve probably noticed it’s not business as usual anymore. Mortgage rates are higher, home prices are sticky, and the real estate game is shifting in ways that will directly impact your next moves.

So what’s really going on? And more importantly, how will these trends affect you, your family, and your future in Arizona?

Let’s dive into what the next five years could look like for homeowners, buyers, and sellers across the Grand Canyon State.

Arizona Home Sales: The Lock-In Effect Is Loosening

For years, homeowners have clung to their homes for one reason: ultra-low mortgage rates. In 2024, 82% of Arizona homeowners had mortgages with interest rates below 6%, according to Realtor.com. That’s like sitting on a winning lottery ticket compared to today’s rates between 6% and 7%.

But life happens. People change jobs, start families, or downsize. That means more homes will eventually hit the market in Phoenix and beyond. The lock-in effect is fading, but slowly.

For Buyers:

Be prepared to act when inventory levels rise. More listings mean more choices, but prices may stay high.

Don’t gamble your down payment. Experts recommend sticking to safe options, such as high-yield savings accounts or short-term CDs, if you plan to buy in the next few years.

For Sellers:

Get ahead of the curve. As more homeowners list their properties, you’ll face increased competition. But if mortgage rates drop faster than expected, Arizona could see a buying boom, and you’ll want to be ready.

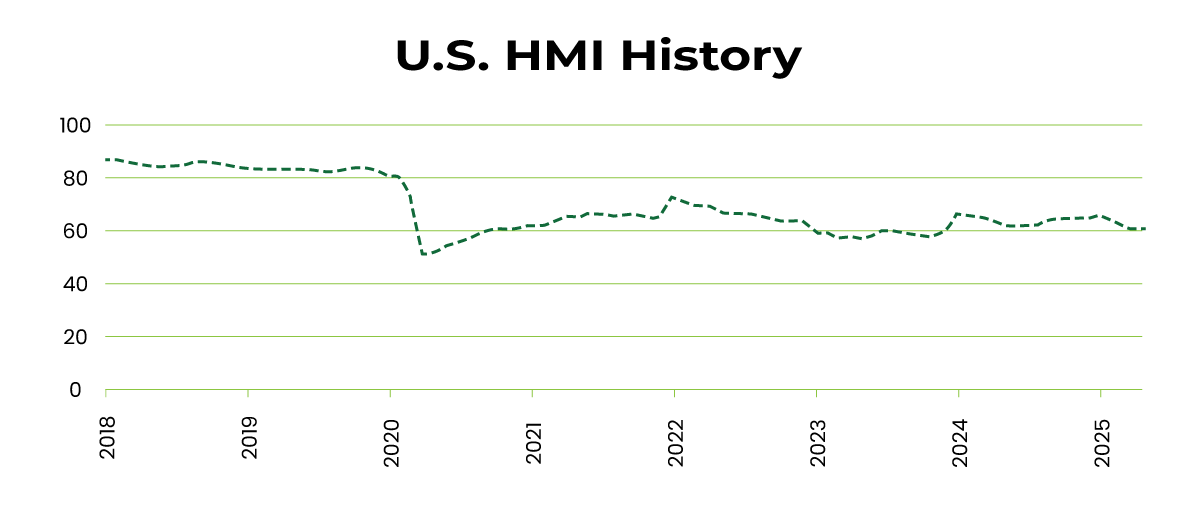

Arizona Builders Are Offering Deals For Now

Arizona’s homebuilders have been working overtime to meet demand. New construction now makes up nearly 30% of homes for sale, especially in the Valley’s suburbs.

But builders are pulling back. High mortgage rates have slowed sales, leaving them with extra inventory. Currently, they’re offering generous incentives to persuade buyers, such as mortgage rate buy-downs, closing cost assistance, and even free upgrades.

A recent survey found that 37% of builders are cutting prices by an average estimate of 5%, while 62% are offering incentives. That’s the highest rate of discounts since 2022.

What this means for you as a buyer here in Arizona:

If you’re buying new construction, now is the time to negotiate. Builders want to clear out inventory before rates fall further for them.

But don’t wait too long. As supply tightens and rates drop, these sweet deals could disappear.

The True Cost of Owning a Home in Arizona

Here’s something not enough people are talking about: the hidden costs of homeownership. People think it’s just a mortgage, but it’s actually more than that.

In 2025, the average American homeowner pays approximately $1,783 per month in extra costs, totaling $21,400 per year. That includes maintenance, insurance, property taxes, and utilities. In Arizona, where extreme weather is putting pressure on home systems and insurance costs, these numbers can climb even higher. We all know how hot Arizona gets!

Compare that to renting:

The midpoint monthly rent for a single-family home in Arizona is $2,296, which is significantly less than the total ownership cost of $4,000 for many homeowners currently here in the Valley.

Your Next Move:

Buyers: Consider newer homes that need less maintenance in the early years.

Renters: Renting might save you money today, but it won’t help you build equity.

AI Is Changing Where and How We Live

Artificial intelligence isn’t just a tech buzzword; it’s reshaping real estate in Arizona. By 2030, AI could automate 30% of work hours in the U.S., according to McKinsey.

What does that mean for housing?

More remote workers are moving to Arizona’s suburbs and small towns.

AI-powered tools streamlining real estate deals, from listings to loans.

Agents focus more on relationships and negotiations, while AI handles paperwork.

There’s also a cultural shift happening: As AI makes life more efficient, people may start valuing unique, handcrafted homes and human connections even more.

Will Zillow and Realtor.com Still Matter? Maybe Not.

Significant changes are coming to how homes are listed for sale. Some of Arizona’s top brokerages, like Compass, are holding listings back from public platforms like Zillow to “test the market” privately first.

That’s called “seller choice,” and it’s shaking up the industry.

Compass says this strategy helps homes sell faster and for more money. However, it could lead to a fragmented market, where buyers will have to visit several offices or websites to view all the available items for sale.

Why it matters to you:

Buyers: Work with an agent who knows the Valley’s “pocket listings” and has inside access to that.

Sellers: Private listings can avoid public price cuts, but they may also reduce your exposure to potential buyers.

Labor Shortages, Immigration, and the Cost of Building in Arizona

Arizona’s housing shortage isn’t going away overnight. Experts say we’re short by 4.5 million homes nationwide, and Arizona is feeling that crunch hard.

But immigration crackdowns and rising tariffs are making it harder to build. Many construction workers are undocumented, and deportations could drive up labor costs and slow new builds.

That’s bad news for supply and for buyers hoping prices will drop.

Arizona Real Estate Predictions: 2025-2030

Here’s where the experts think we are headed:

Home Prices

Following significant jumps in 2024, price growth is expected to slow down.

Some Arizona markets, especially in the South and Southwest, could see price drops.

By 2030, expect total home price growth of about 10% to 11%, mostly keeping pace with inflation.

Home Sales

Sales hit record lows in 2023 and 2024 but will start climbing again slowly.

New home sales may dip in 2025 but are expected to bounce back by 2026.

Labor shortages could keep supply tight, pushing prices higher again.

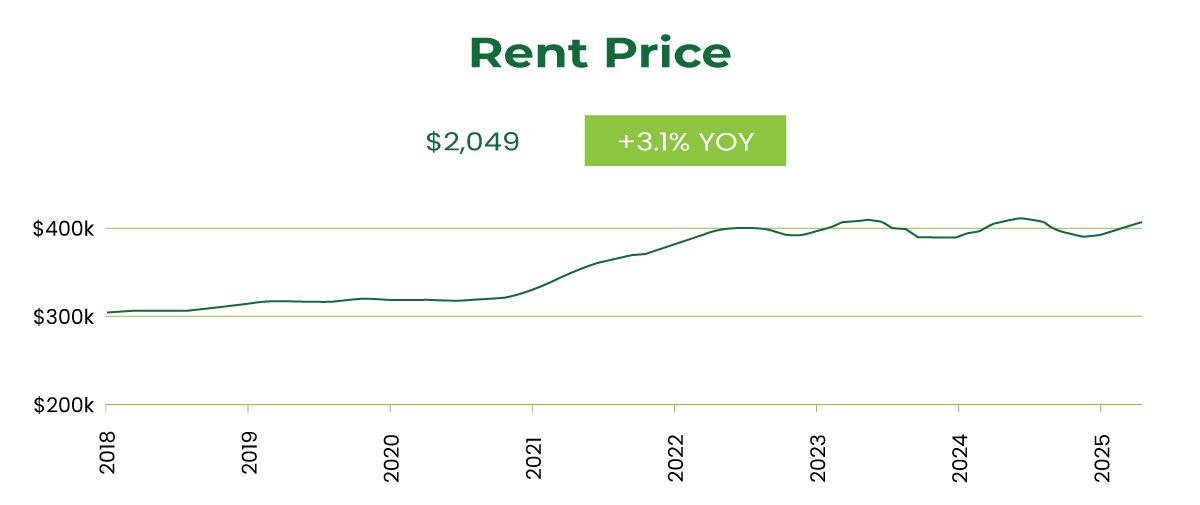

Renting vs. Buying

Rents are expected to continue rising, particularly for single-family homes.

By 2026, as new construction gets absorbed, vacancy rates will shrink, and rents could spike again.

The Bottom Line for Arizona Homeowners and Buyers

Whether you’re buying, selling, or staying put, the Arizona real estate market is changing fast. Mortgage rates, AI, labor shortages, and rising costs are reshaping the landscape.

But knowledge is power. The more you know, the better you can protect your investments, grab opportunities, and avoid costly mistakes.

Want to keep up with your best next move in Arizona real estate? Please stay connected with Amazing Arizona Blog; we’ve got you covered.