Phoenix Metro’s $7.1m Land Deal Signals a New Era of Opportunity

Despite mortgage interest rates hovering around 8%, homebuilders in the Phoenix metro market still show strength by paying millions of dollars in cash to buy lots.

According to the latest Phoenix Housing Market Letter by RL Brown Housing Reports, homebuilders in Metro Phoenix are not waiting for lower mortgage rates. The report focuses on housing marketing data and research.

According to the latest report, there has been a 2.86% year-over-year increase in new home closings from January to May. The total number of closings for the year so far is 9,522, an increase from the 9,257 recorded last year.

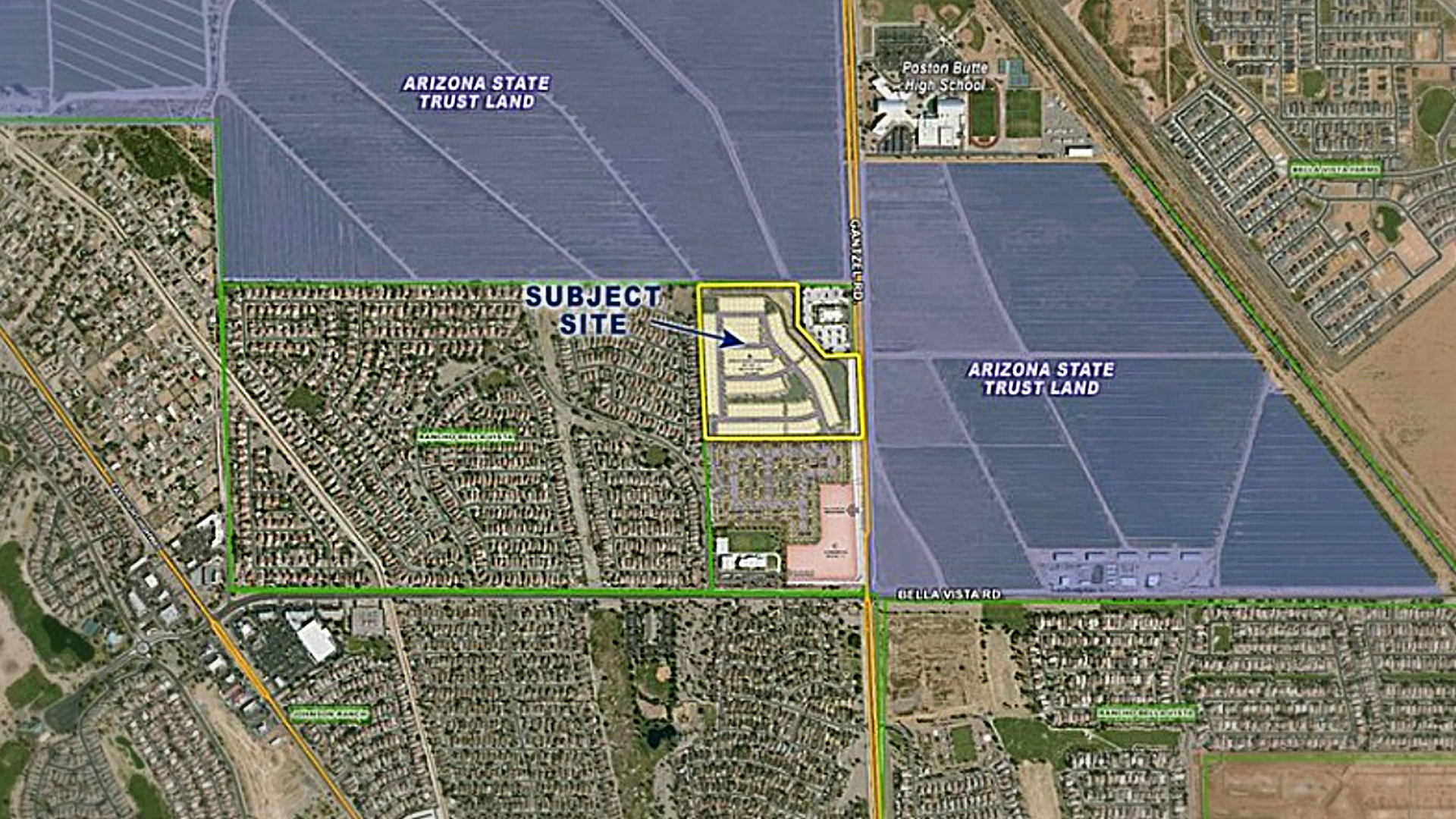

KB Home (NYSE:KBH) provides an example of this, having recently acquired 35.3 acres in San Tan Valley with plans to construct 133 homes.

According to Tempe-based real estate database Vizzda LLC, a Los Angeles-based homebuilder got a piece of land north of the northwest corner of N. Gantzel and E. Bella Vista roads for $7.1 million in cash. Harvard Investment Inc., based in Scottdale, led the partnership that sold the land. Nate Natha and Courtney Buck, from Scottdale-based Nathan & Associates Inc., worked as representatives for both the buyer and seller in the transaction.

Kevin McAndres, president of KB Home’s Phoenix Division, says land development will begin this month.

“KB Home has been growing its presence in Phoenix, and we are thrilled to be constructing homes in San Tan Valley,” he said. “We understand the popularity of this growing submarket, which offers a unique combination of a high-quality lifestyle and affordable prices.”

The homes will range from 1,400 to 2,500 square feet and will include three to four bedrooms and two to 2.5 baths.

The community known as Bella Camino will include a park with a children’s play structure, picnic tables, and a grilling station.

While the land purchase is in the far southeast valley, most recent land acquisitions have occurred in the far west valley. This area still offers land purchase and development.

Meritage Homes focuses on Buckeye in the latest land agreement.

According to Vizzda, the Nathan & Associates team has been actively involved in regulations, including the recent $6 million sale of 40.16 acres at the northwest corner of Apache and Beloat roads in Buckeye.

Scottdale-based Meritage Homes Corp. (NYSE:MTH) made a cash payment to a limited partnership associated with Vaulter Real Estate Investment, formerly Mcrae Gomez Cos. Vizzda said.

Vizza said that the 40 acres includes 161 platted and engineered lots.

Meritage purchased the land on June 14, 2024, and plans to spend the next 12 months in the development phase.

In Buckeye, Nathan, Duncan, Baldwin, and David Mullard worked together with Bret Rinehart and Ryan Semro of Land Advisors Organization to successfully negotiate the acquisition of 82.2 acres by Arlington, Texas-based D.R. Horton Inc. for $12.3 million, Vizzda said.

According to Vizzda, D.R. Horton purchased the land east of the southeast corner of State Route 85 and Interstate 10 from a source associated with the Kemper &Ethel Marley Foundation and Garett Development Corp.

In the West Valley, in Surprise, Brookfield Property Group bought 188 finished lots from Courtland Communities for $19 million. The lots are located west of the northwest corner of Grand Avenue and Deer Valley Road, as reported by Vizzda.

“The closing was a strategic move for Ashton Woods homes,” said Troy Wahlberg, vice president of investments for Brookfield Asset Management in Scottsdale.

According to Vizzda, the option agreement with Ashton Woods will expire on March 31, 2025. Nate Nathan, Nathan & Associates’ president and designated broker successfully negotiated the transaction.

Lennar Corp., based in Miami, participated in a land banking deal in the West Valley, purchasing 29 finished lots at Verde Trails II in Avondale.

According to Vizzda, an entity associated with DW Partners/Domain Real Estate Partners sold Lennar the land east of the southeast corner of Avondale Boulevard and Broadway Road for $2.1 million.

These land deals follow several previous acquisitions made by homebuilders earlier this year. Mattamy Homes, a company based in Orlando, Florida, has recently started development on six new communities in the Valley. These communities will consist of a total of 1,473 homes. At least two years ago, Mattamy Homes had purchased most of the lots for these communities.

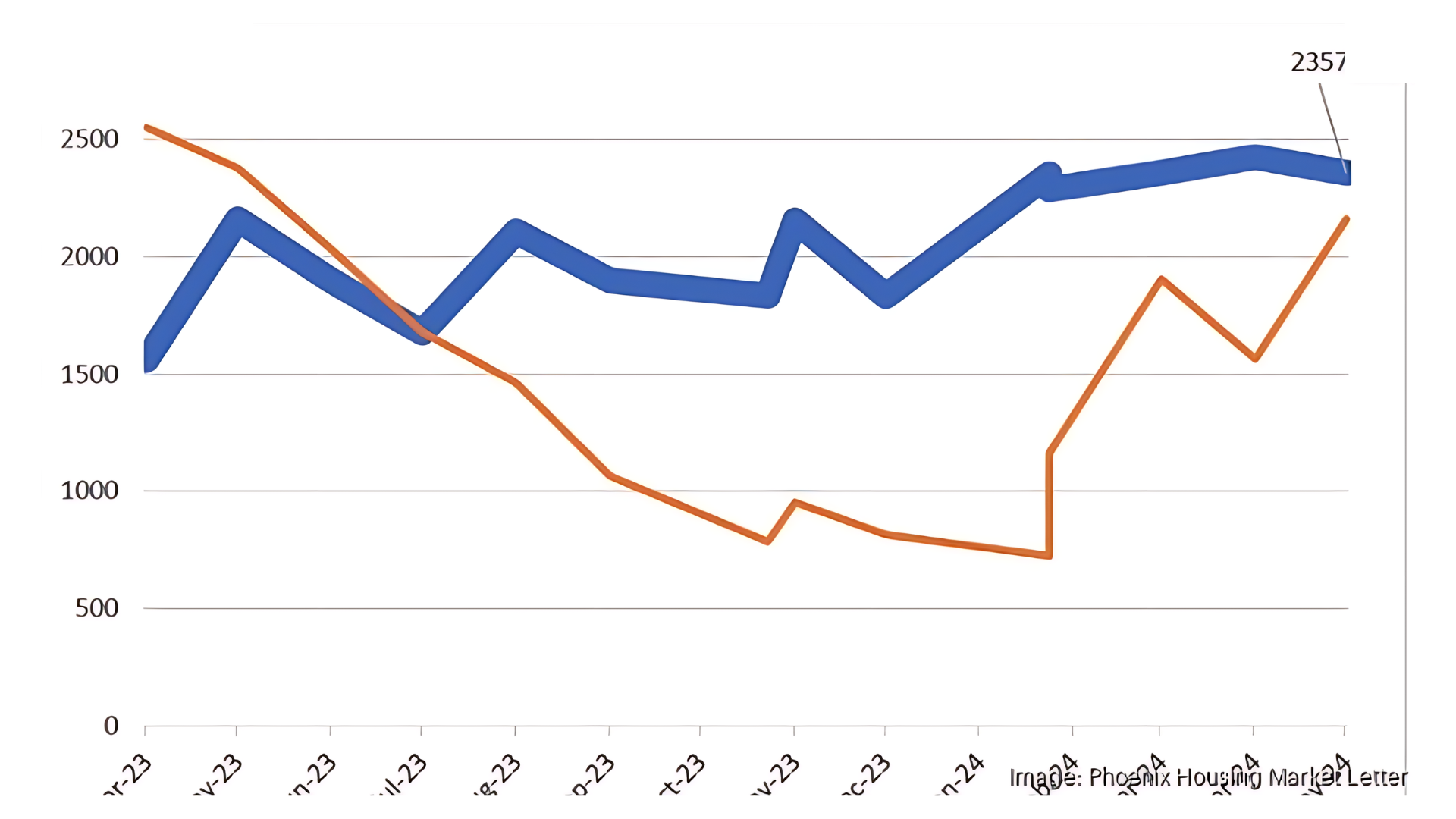

Homebuilders have seen a major increase of almost 57% this year at Phoenix Metro

As stated by Don Barrineau, the Phoenix division president for Mattamy Homes, the increase in interest rates to 7% led to a temporary stop in development for many homebuilders, including Mattamy Homes.

According to the Phoenix Housing Market Letter, homeowners got 11,775 permits for single-family homes between January and May. This reflects an increase of 56.77% compared to the same period in 2023.

The median price for existing homes in May was $448,400, indicating a 0.76% increase compared to the previous year.

The CoreLogic S&P Case-Shiller index fell in April, with a 6.3% year-over-year gain. This comes after almost 10 months of increasing annual gains.

“In April, Phoenix home prices noticed a 4.8% increase compared to the previous year,” she said. “The recent increase in prices in Phoenix has posed a challenge to the metro’s affordability. Despite being known for its affordability compared to other areas in the west, the slowing growth of home prices will benefit potential home buyers in the future. Also, the expected drop in mortgage rates later this year will also help them.”

The Phoenix Housing Market Letter reports that despite increasing prices and financial costs, the demand for new housing is still stable.

According to the data, the new home construction community successfully meets the housing demand without any noticeable concerns about overproduction.