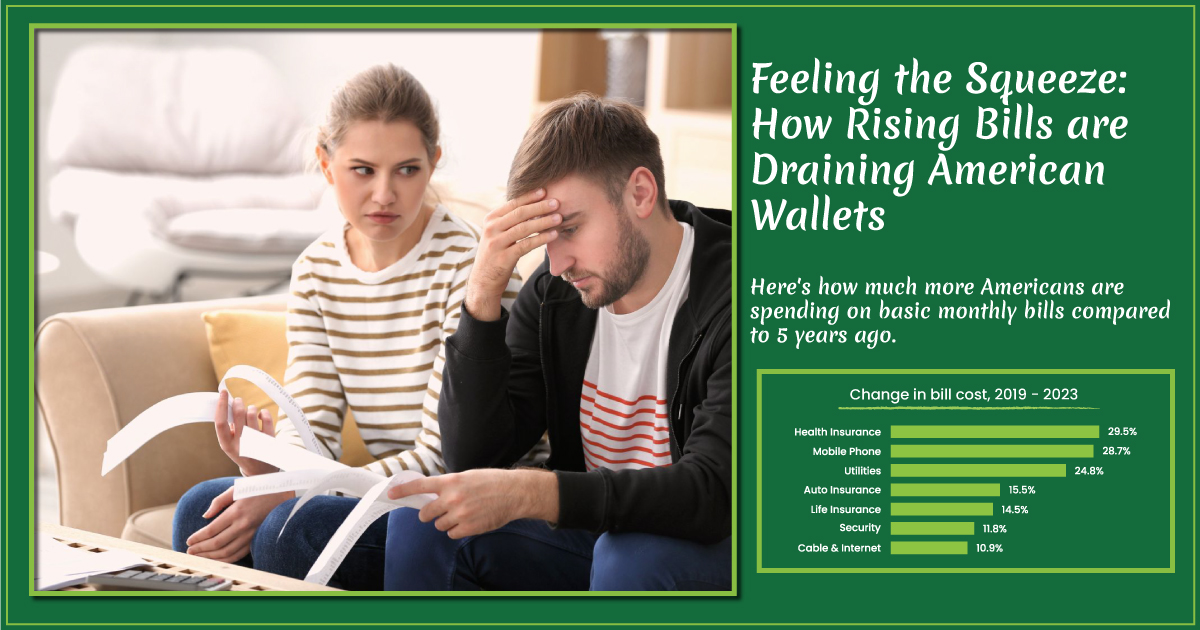

Here’s how much more Americans are spending on basic monthly bills compared to 5 years ago

Feeling the Squeeze: How Rising Bills are Draining American Wallets.

Hey there, savvy savers and budget battlers! It’s Geoff, diving into the wallet woes that are hitting American homes harder than a summer heatwave. Hold on to your hats (and your wallets), because I’ve got the scoop on just how much more we’re shelling out on those pesky monthly bills compared to just five years ago.

The average U.S. household spends $25,513 each year on the top ten most common bills, consuming a substantial 34% of the median household income. The main culprits? Mortgage, rent, and auto loans dominate these expenses, significantly limiting financial flexibility.

Thanks to a recent report from Doxo, the data wizards of bill payments, we’ve seen the monthly payments to the top ten bills surge to $2,126. That’s up 4% from last year and a staggering 19% increase since 2019. Meanwhile, the median household income has barely budged, inching up just 0.2% in the last year and a total of 14% since 2019.

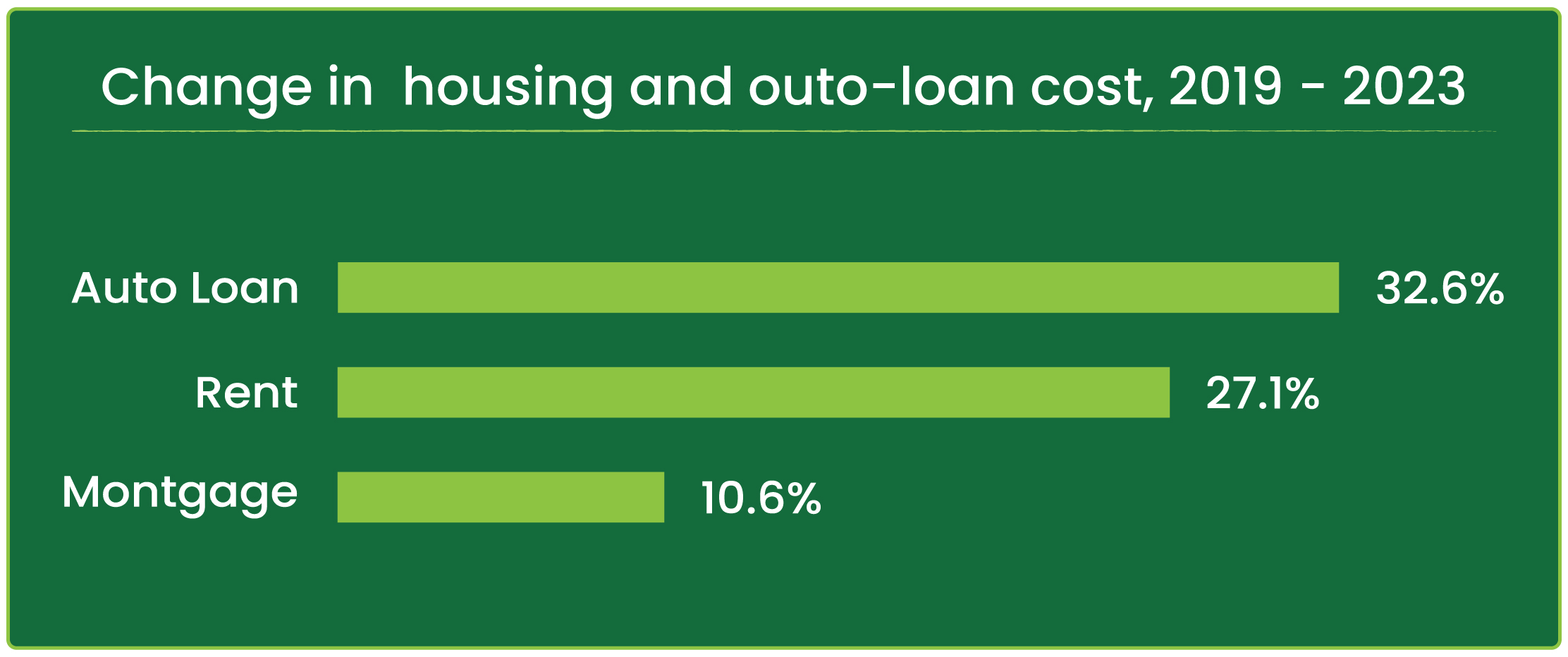

Mortgages are climbing with an average monthly payment now at $1,402, an 11% jump from 2019. Renters aren’t getting any relief either, with rents ballooning 27% to an average of $1,300. And let’s not forget about those car payments, which have revved up 33% to an average of $496. It’s a tough market, folks—whether you’re buying, renting, or just trying to commute.

And while some might hope for a market cool-down, Lynnette Khalfani-Cox, a personal finance guru, reminds us that it’s not just about interest rates. The lack of affordable homes and rental units is cranking up prices across the board, giving landlords and sellers the upper hand in a tight market.

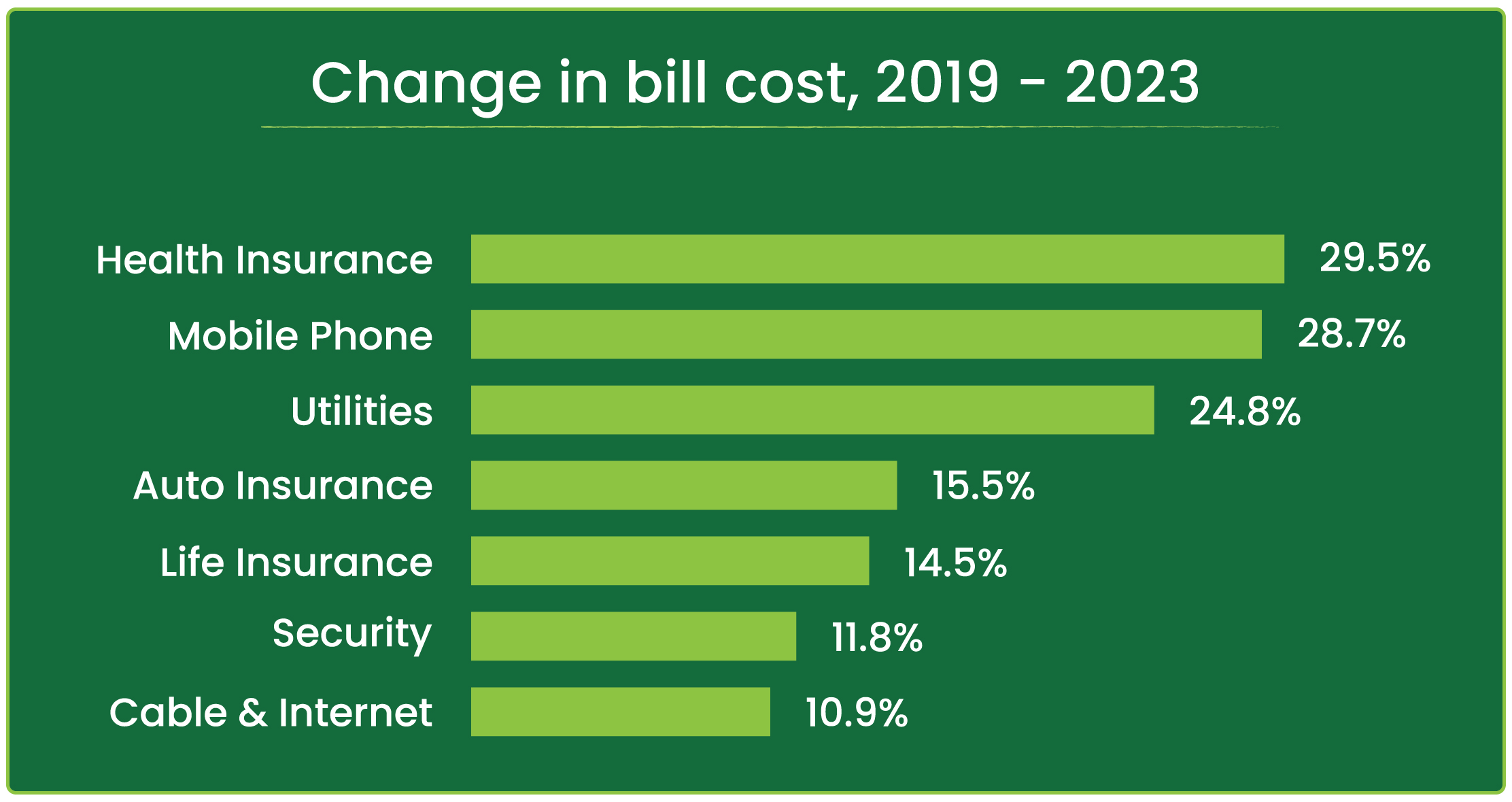

But wait, there’s more—utilities, mobile phones, and health insurance have seen the sharpest hikes. Your monthly utility bill now averages $362, up a shocking 25% since 2019. Cellphones? They’re not just smart; they’re expensive, with costs up 29% to $121 monthly. And health insurance ticks up to $114 each month, a 30% increase.

While auto insurance, cable, internet, life insurance, and home security bills are also on the rise, they’re playing a bit gentler on our bank accounts, but every little bit adds up in today’s economy.

And it’s not just these bills that are biting. Khalfani-Cox points out that hidden costs like escalating food prices and other essentials are also gnawing away at our finances, making it harder to keep pace with an ever-inflating cost of living.

So, what’s a wallet-watcher to do? It’s more important than ever to keep a keen eye on where your cash is going, and maybe, just maybe, find some creative ways to tighten those belts without squeezing the fun out of life. Here’s to hoping for a break in the clouds of this financial storm!