Fed’s Optimistic Outlook: Rate Cut Expected Amid Encouraging Inflation Trends in 2024

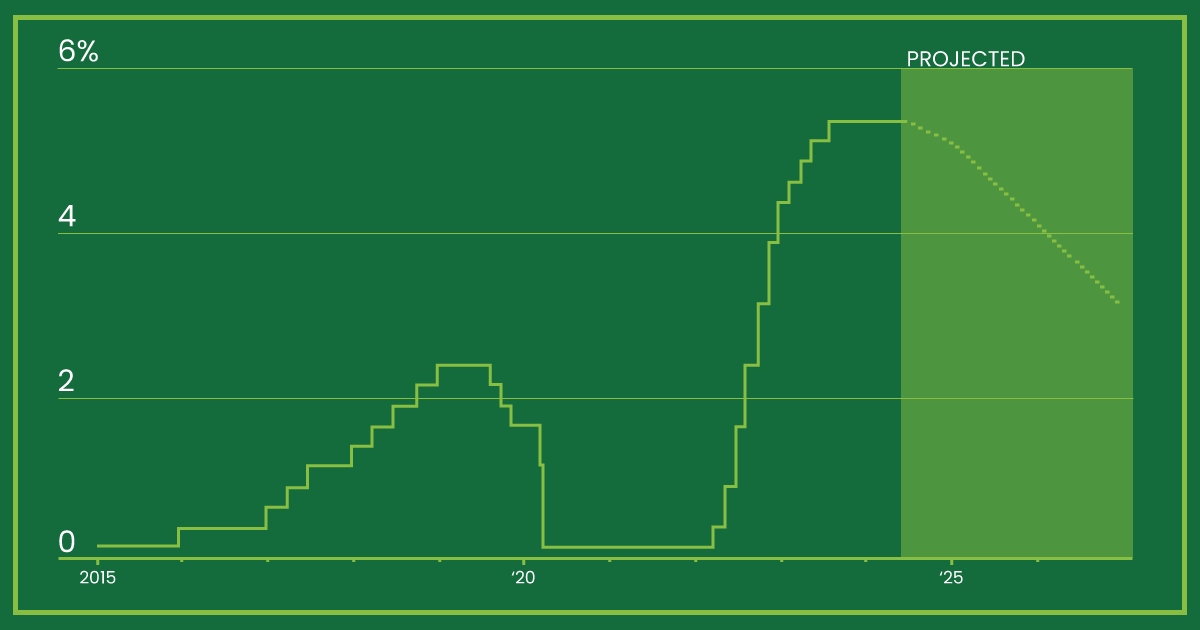

Federal Reserve officials have projected just one interest-rate cut for this year, indicating that most are not in a hurry to lower rates, even after a widely observed report on Wednesday showing improved inflation last month.

The central bank also maintained its benchmark rate within the range between 5.25% and 5.5%, a decision that was widely anticipated.

New economic projections reveal that 15 out of 19 officials anticipate the Fed will reduce rates this year, with the group roughly divided between expecting one or two rate cuts. The median of these projections indicates expectations of one reduction.

Fed officials will meet four more times this year, in July, September, November and December. The rate projections have moderated investors’ expectations of a September cut, which had increased earlier on Wednesday after the inflation report.

Despite setbacks at the beginning of the year, recent inflation readings have shown improvement, Federal Reserve Chair Jerome Powell stated at a news conference. “We’ve significant progress on inflation,” he noted that Wednesday’s report was “a step in the right direction … but it’s important not to be influenced by any single data point.”

“We will need to observe more positive data before we think about considering a rate cut,” he stated.

Powell’s caution did not dissuade many investors during Wednesday trading. The tech-heavy Nasdaq Composite advanced 1.5%, reaching a new record, while the S&P 500’s 0.9% gain also propelled it to an all-time high. Benchmark 10- year Treasury yields decreased to 4.294%, continuing June’s bond rally. In the bond market, prices move inversely to yields.

Target for Federal-Funds Rate

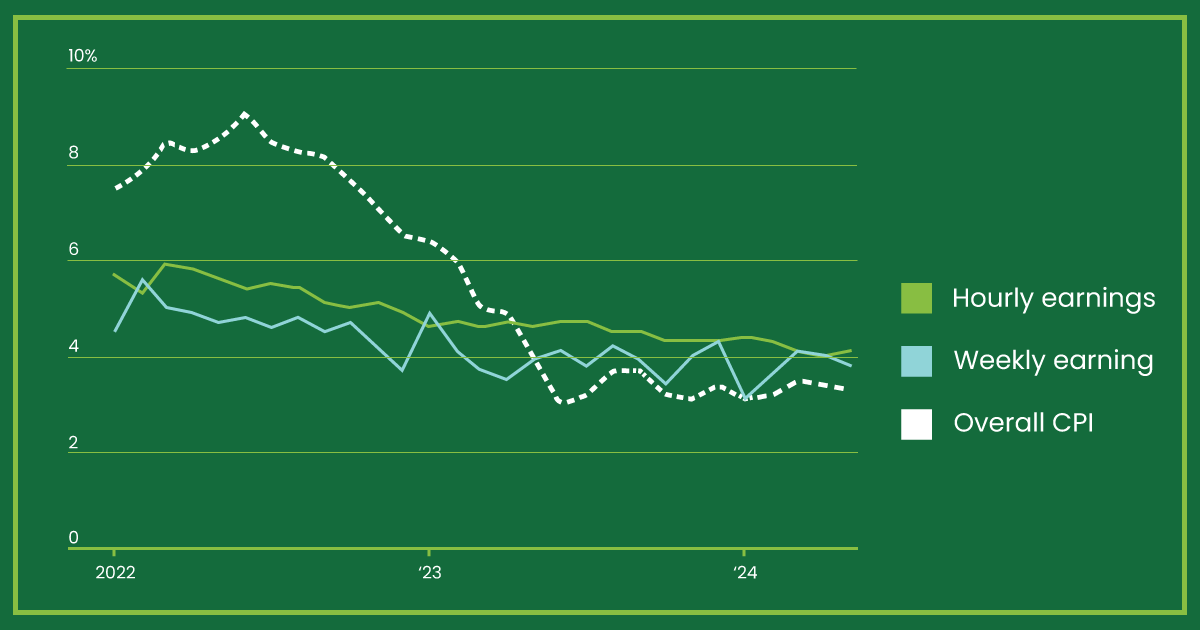

The latest decision by the Fed was announced just hours after the Labor Department reported that the consumer-price index, a measure of the cost of goods and services across the economy remained essentially flat from the previous month and increased by 3.3% compared to the previous year. In April, prices had risen by 3.4%.

Core prices, which exclude the volatile categories of food and energy, experienced their mildest gains since 2021 increasing by 0.2% from April, which was below economists’ expectations.

“This was a very encouraging figure,” said Laurence Meyer, a former Fed governor who now leads an economic advisory firm. “Although more data is needed before considering a rate cut, but I believe September is a possibility for the first-rate reduction.”

The report indicated a broad-based slowdown in price pressures, which could help Fed policymakers regain confidence that inflation will return to their target.

Officials were surprised in the latter half of last year by the rapid declaration in price growth, despite strong spending and hiring. Inflation subsequently reversed course, becoming unexpectedly high at the start of this year, which derailed the expectations of both investors and the Fed itself that the central bank might have been able to cut rates by now.

Investors were highly attentive on Wednesday to whether a majority of the 19 officials who submit quarterly interest-rate and economic projections would forecast two rate cuts or just one. In March, a narrow majority had anticipated three cuts, but persistent inflation readings effectively reset the expectation on rebuilding confidence that inflation will decrease over the next year.

Officials sent their rate projections to the Wall Street Journal Google late last week and could revise them up until the end of Wednesday’s meeting. Some analysts thought the projections seemed outdated given the CPI data and might show a reluctance to change them based on a single data. Powell, pointed out the officials’ cautious stance in modeling inflation, calling the forecasts behind these rate projections as “conservative” twice.

Officials will receive just one more inflation reading before their next policy meeting in July, but they will have three additional monthly reports by the time of their subsequent meeting in mid-September. The September meeting will be the Fed’s final gathering before the November. 5 presidential election.

“The narrative is that they’re not prepared to cut rates. We are experiencing fluctuations in inflation. So, caution is necessary,” said Meyer.

Change in Consumer-price index, from a year earlier

The Fed raised rates at the fastest pace in decades, during 2022 and 2023 years to combat high inflation, and many economists have been impressed by the economy’s resilience to increases thus far.

Powell and his colleagues are reluctant to cut rates without more convincing evidence that their policy stance is as restrictive as intended. However, they are concerned that by the time this evidence appears, it may be too late to prevent a significant rise in unemployment.

They face two risks. One risk is that there could be further difficulties as banks and businesses, which are least prepared for and most vulnerable to higher rates, may encounter serious challenges if rate cuts do not occur in the coming months as widely anticipated.

Changes in Wages and Prices, from a year earlier

The other risk is that rate cuts could spark market rallies and increased spending, which would keep inflation above the Fed’s 2% target. This target is measured against a separate index maintained by the Commerce Department, where core prices increased by 2.8% in April.

On Wednesday, officials increased their inflation projections and now expect core prices to rise by 2.8% in the fourth quarter compared to a year earlier, up from 2.6% in their March projections. They anticipated core inflation to slow to 2.3% the next year and 2% the following year.

Last week, central banks in Europe and Canada implemented their first interest-rate reductions of the current cycle. Economic growth has been weaker abroad compared to the U.S., where many homeowners have been protected from the impact of higher interest rates due to locking in ultralow 30-year, fixed-rate mortgages in 2020 and 2021.

Fed officials have been perplexed in recent months as to why their interest-rate stance, which affects the cost of mortgages, business debt, auto loans and credit cards, hasn’t done more to slow the economy. However, several measures of labor-market conditions have returned to levels last seen in 2018 and 2019, when growth was solid and inflation was low, indicating that monetary policy and the resolution of pandemic-related disruption has led to a slowing in economic activity.

Powell attempted to explain this enigma by highlighting how a surge of immigration and workforce participation last year boosted demand and increased the economy’s capacity to supply more goods and services.

Despite steady job and income, Americans remain pessimistic about the state of the economy even though overall growth and significant gains in asset prices such as stocks and houses are driving spending.

Consumers are finding little relief from milder annual inflation rates because the price increase for everything from housing to groceries to cars since 2021 have been unusually large. Over the last four years, prices have risen by 22% according to the CPI, compared to a 7% increase in the four years prior.

Furthermore, slower inflation has not yet resulted in lower borrowing costs: The 30- year fixed-rate mortgage has remained around 7% in recent months, nearing its highest level since 2001, while banks are charging 22% interest on credit cards.