How Inflation Is Redefining the American Middle Class 2024

Vincent, aged 29, lives in America, thriving as a medical sales representative, indirect aggressive annual earned income of $130,000, which reflects the profitable earning possible within the healthcare sales industry.

From a young age, he wished to reach a six-figure salary, visualizing it as the key to financial pleasure. He visualizes a life where annual vacations and home ownership were not just hoped but approaching reality.

Vincent, who took to sharing only his first name for privacy reasons, once accepted that earning a six-figure income would cover the way to a secure life. He intends to save enough for a home down payment as the first step on the way to starting his new life.

He was amazed to find out that in Santa Barbara, a coastal California City where the cost of living is 65% higher than the state average, he’s hardly able to save for anything, let alone buy a house, plan for kids, or hit another major achievement of middle-class life.

Vincent pointed out that extensive purchases such as homes or cars, once reachable for previous generations, now seem beyond his reach. However, he recognized that relocating to a city with a lower cost of living could stretch his budget further.

“Vincent shows that he would need to diligently save $10,000 annually for six to seven years and make significant sacrifices, just to pay for the most modest property available in his area.”

Vincent’s condition illustrates the shifting dynamics of the middle-class American dream. Despite earning a six-figure salary, many like him feel they are falling behind, grappling with a financial state that seems progressively stacked against them.

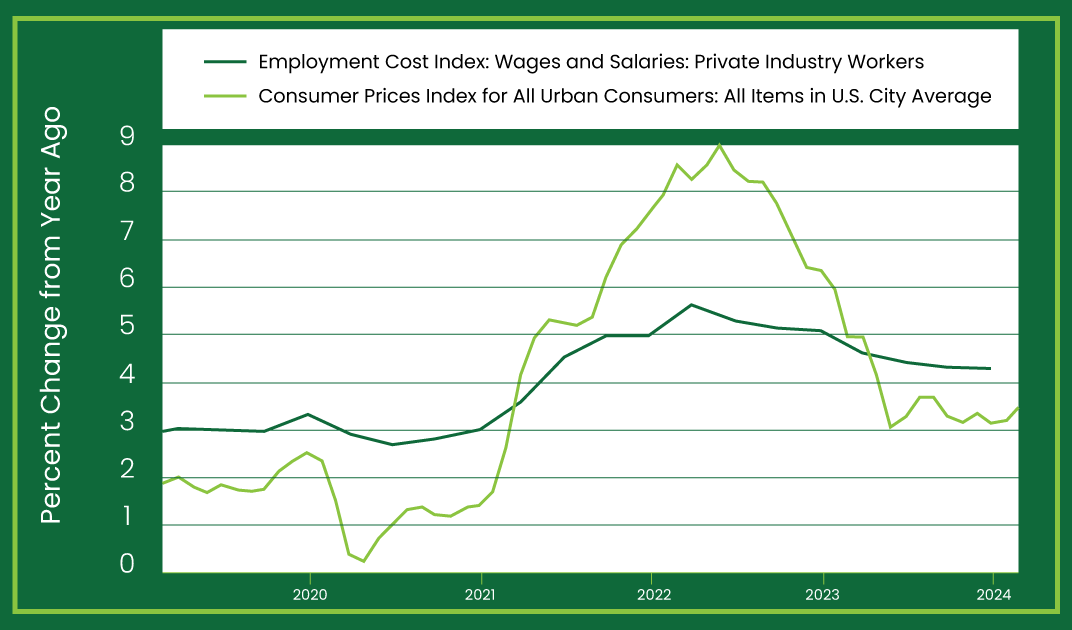

Some of these concerns are grounded in reality, especially with the sky-high-priced U.S. housing market. However, specialists hypothesize that other worries stem more from aspirations and dreams rather than reality. Despite demanding economic sentiments, the facts show that earnings are rising, and employment remains robust.

Vincent belongs to an expanding division of middle-class Americans, defined by the Pew Research Center in 2022 with households earnings between $48,500 and $145,500 yearly. Despite their incomes, many in this group feel that the historical markers of middle-class life, such as homeownership and secure retirement, are growing out of reach.

Eoin Sheehan, a senior research analyst at Redfield & Wilton, says that inflation has led many Americans to notice the overall robustness of the US economy.

Economic growth, robust hiring practices, and strong financial markets identify the current landscape, with wage growth now starting to surpass the rate of inflation.

Chris Collins, a wealth advisor at Northwestern Mutual’s Collins Financial, declares that higher costs are promoting challenges for retirement and home buying, but these goals remain achievable with careful financial planning.

Collins believes that the prevalent anxiety among middle-class Americans about their financial situation comes from financial shock fatigue, constant stress from suffering one major financial crisis after another compounded by insufficient financial planning.

According to Collins, his clients normally begin to feel more at ease once they look over their finances and settle how much they need to save for retirement or other financial goals. Before this analysis, many mistakenly believed that they would need to work permanently.

“Collins highlights the positive result of financial planning, stating, ‘I don’t tell my clients they’ll face an open future. Instead, I reassure them that with some careful planning, they’re going to be outstanding.’ He notes that his clients often cannot unwind until they see a detailed financial plan and model that confirms their financial stability.”

Despite official confidence, many households feel differently about their financial and wealth reputation. This point of view is widely conveyed across social media, where users identifying as middle-class report feeling increasingly less comfortable.

“Jessica, a TikTok user from Alabama, is concerned that the middle class is decreasing. She highlighted the suffering of her eldest daughter, who supposedly worked 60 hours a week during her pregnancy to support her family. “

“Jessica investigated the continuation of the middle class, emphasizing a stark economic divide, In a TikTok Post. She mentioned, ‘Is there even a middle class anymore, or just the haves and the have-nots? The haves continue to prosper, while the have-nots face rising struggles.”

“Kayla, a TikTok consumer, shows suspicion about financial ease amid families with children. She declares, ‘I’m sorry, but if someone with kids states they’re not struggling financially, they’re not being honest.’ She attributed this to the escalating costs of groceries and other necessities”

“Vincent moves back to the tasks faced by the average class, splitting, ‘Honestly, life is tough for us. I can make ends meet but moving along beyond this lifestyle just isn’t practicable.”

Exploring the America's Cost-of-Living Crisis

The economic point of view among middle-class Americans has been progressively negative for some time, with a remarkable escalation of this negative idea in recent years.

Financial apprehension among Americans has stretched to unparalleled levels, as reported by a Northwestern Mutual survey. Additionally, a Primerica survey discloses that half of middle-class households describe their financial state as ‘not so good’ or ‘poor.’

Inflation is a national concern for many middle-class Americans. They’ve identified inflation as their main barrier to financial security. Moreover, 67% of households believe their current income is not safe nor sufficient enough to keep pace with the rising cost of living.

Economic tension is causing many to feel excluded from traditional middle-class milestones. Middle-class Americans have lessened non-essential spending.

Many Americans are facing unpredictability about retirement as they dip into their savings to manage current costs, 60% of Americans believe they are not saving adequately to ensure a comfortable retirement.

Practically half of middle-class Americans, 46%, have reported either lowering or completely breaking their future savings. Additionally, 38% admit they would struggle to cover an unexpected expense exceeding $1,000.

Sheehan noted that worries surrounding traditional middle-class milestones, such as homeownership and higher education, are increasing rapidly. Many Americans, who once saw these achievements as a measure of middle-class status, now believe they are increasingly out of reach.

Homeownership, a foundation of middle-class life, continuously feels unachievable for many. This challenge is a tactile issue, not just a negative appreciation.

With mortgage rates near a 23-year high and home prices barely within-reach levels, Americans now need to earn 80% more than pre-pandemic levels to pay for a home comfortably. First-time homebuyers account for less than a third of all home purchases in 2023, marking one of the lowest portions ever recorded by the National Association of Realtors.

Vincent believes that having a home is contemporarily out of reach. By lowering expenses and embracing a frugal lifestyle, he evaluates he could save up to $10,000 yearly. Even with these savings, it would take him at least eight years to stockpile the average down payment of $84,000.

We hope this inspires you to start managing your finances! What steps will you take to make your dreams become reality?